per capita tax bethlehem pa

Local Economic Revitalization Tax Assistance. Historically Real Per Capita Personal Income for Allentown-Bethlehem-Easton PA-NJ MSA reached a record high of 5390400000 in January of 2020 and a record low of 4262700000 in.

4 Palestinian Trade Performance Prospects And Policy In The West Bank And Gaza

A full time student as of July 1 of the tax year.

. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000. Business Privilege and Mercantile Tax. Act 511 Taxes for Pennsylvania School Districts Glossary of Terms.

Do I pay this tax if I rent. Combined income from wages salary fees pensions. PO BOx 519 IrwIn PA 15642 Fax.

Access Keystones e-Pay to get started. Revenue Office -- 1 st Floor. The school district as well as the township or borough in which you reside may levy a per capita tax.

You must file exemption application each year you receive a tax bill. Per capita tax bethlehem pa. Per Capita Exoneration Change of Address for Tax Billing.

A B C D E F G H I J K L M N O P Q R S T U V W X Y All. ARTICLE 329 Property Tax 32901 Rates 32002 Payment dates. 2009 in January of 2020 according to the United States Federal Reserve.

Portnoff Law Associates 1-866-211-9466 www. Per capita exemption requests can be submitted online. Act 511 Taxes Flat All taxes levied on a flat rate basis in accordance with Act 511 of 1965.

Exoneration from tax is applicable to the current tax year only. 1-412-927-3634 Per CAPItA tAx exemPtIOn APPlICAtIOn Name Address Phone Account Invoice SSN Moved Previous address May not exceed 10000 from all sources which includes but is not limited to. To insure uniformity all payments must be accompanied by a tax bill in the standard format.

ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be. It can be levied by a municipality andor school district. The City of Bethlehem imposes an amusement tax on all events with a capacity of 200 or more attendees which charge more than 1000 per ticketadmission.

A 10 fee would generate 372470. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the. Per Capita means by head so this tax is commonly called a head tax.

Northampton County Department of Human Services Building. Northampton Area School District Per Capita Real Estate Taxes are collected by. Revenue Office - 2nd Floor Room 2132.

School district real estate tax. What is the Per Capita Tax. 4225 Easton Avenue Bethlehem Pa.

In addition amusement event holders must obtain a permit to hold events. 6120 Current Per Capita Taxes Section 679 500 500 000 Yes 34 Current Act 511 Taxes Flat Rate Assessments 6141 Current Act 511 Per Capita Taxes 500 500 000 Yes 34. Mail Completed Form To.

Those who make less than 12000 per year are exempted from the Tax. Also known as the Local Tax Enabling Act. 19 Lower Saucon Township.

The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Keystone Collections Group Deputy Tax Collector 3700 Old Philadelphia Pk Bethlehem PA 18015 724 978-0300.

The revenue derived from the tax will be used for police fire and emergency services and for road improvement and maintenance. Delinquent Real Estate Tax. It is not dependent upon employment.

What is difference between an ACT 511 and ACT 679 Per Capita Tax. If both do so it is shared 5050. Real Per Capita Personal Income for Allentown-Bethlehem-Easton PA-NJ MSA was 5390400000 Chn.

Please call the Revenue Division at. A 5 per capita fee dedicated to emsfire protection would generate 186205. Grants school districts the power to levy certain taxes with maximum rates set by the General Assembly.

A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Keystone Collections Group Black River Plaza 3606 Route 378 Suite A. Historically Per Capita Personal Income in Allentown-Bethlehem-Easton PA-NJ MSA reached a record high of 5919300000 in January of 2020 and a record low of 386600000 in January of 1969.

CROSS REFERENCES Power of Council to levy property taxes - See 3rd Class 2531 53 PS. Information About Per Capita Taxes. 4225 Easton Avenue Bethlehem Pa.

610-495-7667 Collects Township Real Estate Per Capita Tax Tax Certifications may be obtained by submitting a request and payment of 10 per parcel to Missy King at the address above. 10 Eleanor Drive Spring City PA 19475 Phone. BETHLEHEM AREA SCHOOL DISTRICT Bethlehem Pennsylvania APPLICATION FOR EXONERATION OF PER CAPITA TAX In order to be considered for a temporary exonerationan individual must complete an application on a yearly basis and meet one of the requirements listed below.

Act 511 of 1965. Per Capita Personal Income in Allentown-Bethlehem-Easton PA-NJ MSA was 5919300000 in January of 2020 according to the United States Federal Reserve. Individual Taxpayers Per Capita Tax FAQ 1.

07 Saucon Valley School District Municipality. This new tax of 52 is levied on all individuals who engage in an occupation in the Borough of Fountain Hill.

Per Capita And Real Estate Tax Bills Mailed Keystone Collections Group

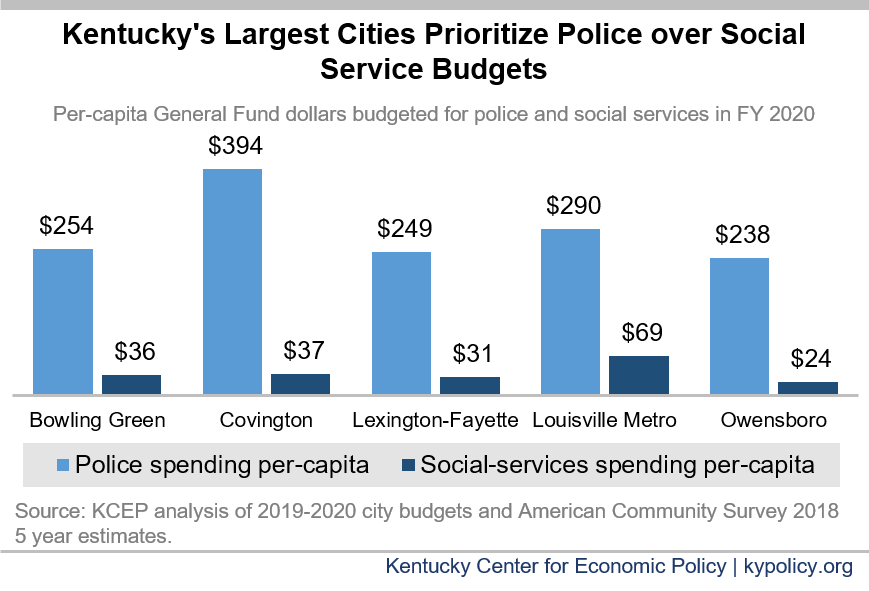

Kentucky S Largest Cities Spend A Quarter Of Their Budgets On Police Kentucky Center For Economic Policy

Pdf An Economic Freedom Index For U S Metropolitan Areas

Information About Per Capita Taxes York Adams Tax Bureau

2 Demographics And Long Term Growth In The Palestinian Economy In The West Bank And Gaza

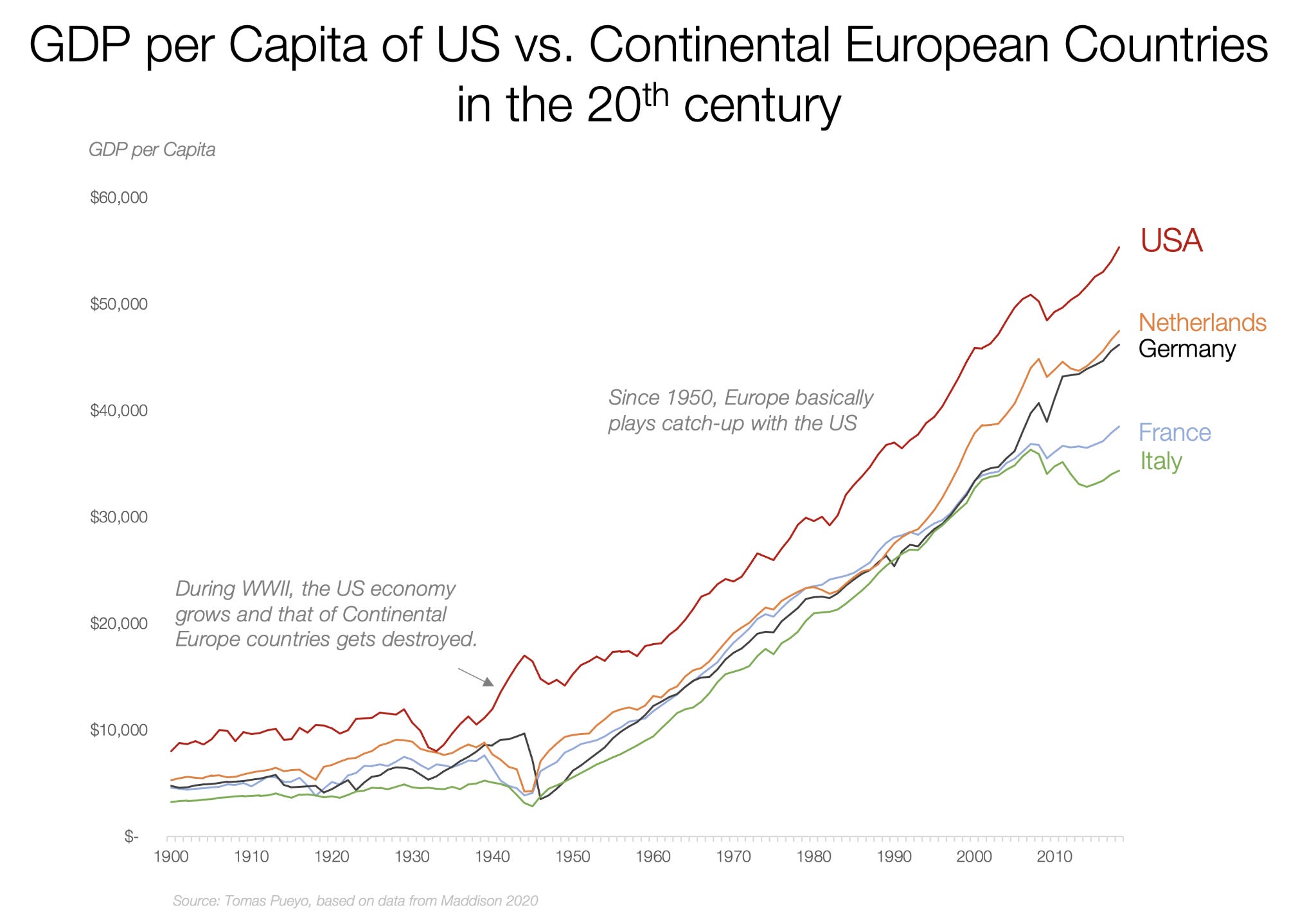

Playing Catch Up With The Us By Tomas Pueyo

Per Capita Tax Exemption Form Keystone Collections Group

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization

Forbes Ranks Bethlehem Pa Top 25 Best Places To Retire City Of Bethlehem City Of Bethlehem

Tax Collection Borough Of Bath

Saucon Valley School Board Eliminates District S Per Capita Tax Saucon Source

Forbes Ranks Bethlehem Pa Top 25 Best Places To Retire City Of Bethlehem City Of Bethlehem

5 Fiscal Policy The Challenges From Demographic Dynamics And Other Medium Term Developments In The West Bank And Gaza